- Above Traffic

- Posts

- Planes, Trains and Automobiles

Planes, Trains and Automobiles

And By Planes, I mean eVTOLs

Friday is here which means the Go Above Traffic eVTOL newsletter is delivered to your doorstep.

Hopefully getting this is like when you were a kid and you got something in the mail with your name on it.

What a great feeling that was…

What you need to know in eVTOLs this week

Joby Aviation

Two weeks ago Joby acquired a company making technology for pilot-less eVTOLs.

And now the FAA authorized “ElevateOS,” the software suite Joby made in house to run a full scale aerial ride sharing network.

The tool includes a flight-booking mobile app for customers, a planning tool for pilots, and an intelligent matching engine that connects available pilots, aircraft, and ground infrastructure resources for each journey.

Sounds familiar? Kinda like how Uber works?

It’s no coincidence. Joby acquired Uber Elevate in 2021. Several employees came onto the Joby during that time. Easy to see they brought a ton of knowledge on building and running these systems.

SkyDrive

Japanese eVTOL aircraft manufacturer, SkyDrive, announced the type certificate application of their three-seat eVTOL has been accepted by Federal Aviation Administration.

Although SkyDrive set up a US based Production Subsidiary in South Carolina in 2023, the FAA acceptance was done through an agreement with JCAB, the Japanese Civil Aviation Bureau

SkyDrive is aiming to bring their eVTOL to market sometime after 2026 so they’ll have to move quickly.

EHang

Who is this white guy and what does he have to do with China based EHang?

His name is Brett Adcock and he founded Archer Aviation (along with Adam Goldstein who is the current CEO).

Brett left in April of 2022 to launch a Figure AI, where he is creating general purpose humanoid robots, but he recently shared some thoughts on EHang and other China based eVTOL manufacturers:

“eHang eVTOL aircraft…is snake oil.

The first order physics of a non-winged eVTOL does not close, it’s not even close. From an engineering perspective there is no business case for range & speed to make this economically viable for mass market travel - it will merely be for 1-2 mile tourism.

They are shown a lot in media because wingless aircraft are much easier to build and fly than winged aircraft (you just hover instead of hover + transition + forward flight in a winged aircraft). The Chinese equivalent aircraft to eHang is Volocopter in Europe and they are close to bankruptcy because of these same engineering decisions.

Other winged-aircraft in China…are purely prototypes with non-certifiable parts. I know this because I’ve also built eVTOL quickly and flown them with non certified parts before. Any company with $50M can do this, it is not hard. If I had to rebuild Archer I could do this again from scratch in 18 months.”

Gotta Love a guy that’s not afraid to put his thoughts out there.

And speaking of Archer….

Archer Aviation

Signature Aviation, a major network of private airport terminals, has signed an Memorandum of Understanding (MoU) with Archer Aviation to “identify day-one opportunities for launching eVTOL air taxi services in the US and globally.”

This MoU also recognizes Archer’s business relaitonship with United Airlines.

United is an Archer investor and will explore opportunities to commence air taxi services in key United hubs at Newark International (EWR) and Chicago O’Hare (ORD) Airports.

Worth noting that it’s fair to be a bit skeptical of MoU’s. They are typically non binding and don’t always guarantee money will exchange hands.

Just ask these companies that had tons of MoU’s:

-Theranos (Bankrupt. CEO in Prison) ,

Solyndra (Bankrupt. CEO now running a different company that just got $6.6B from Biden Administration).

*Side note - We’re giving the guy that burned through $535 million in tax payer money the first time even more money this time?

Fisker Automotive (Bankrupt. CEO outcome TBD)

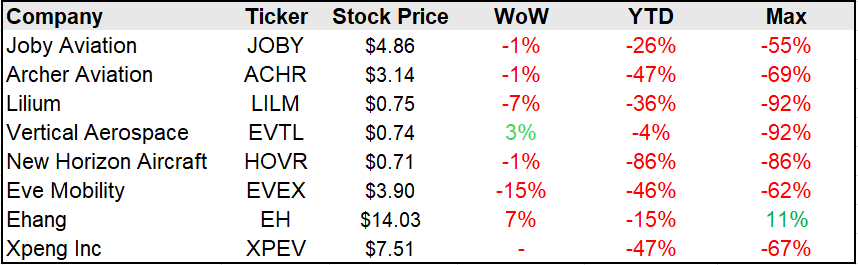

The Markets

Or “The Casino” if you prefer the Wall Street Bets mentality…

Another week, another beating.

Nothing to be excited about in the eVTOL equities markets. Minimal movement and none of it going up.

Early stage companies with little to no revenue don’t trade on any fundaments so they can move which ever way the wind blows.

And there were headwinds this week.

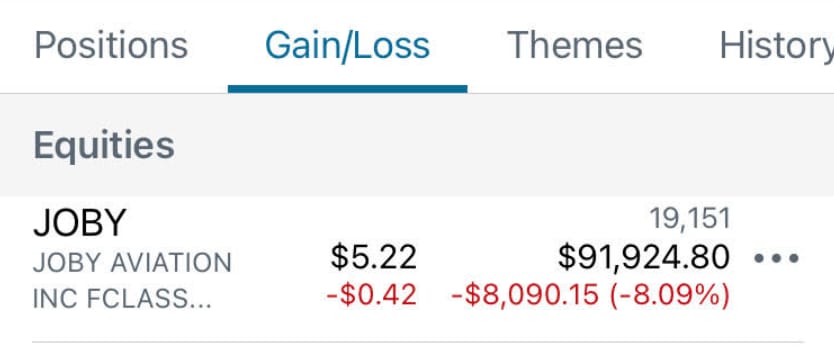

The $100K Life Savings Bet

"Avoid the long shots. I’ve bought about 30 long shots in my life. I’ve never broken even on one of them.”

— Peter Lynch

If you’ve never heard of Peter Lynch, he’s a famous investor (in the finance world) known for managing Fidelity’s Magellan Fund.

He’s worth about half a billion dollars so probably knows what he’s talking about.

This quote brings two questions to mind:

1) Are eVTOLs a long shot?

2) Is it a long shot that Joby will be the winner in the eVTOL space?

I have $100K on the answer to both of the above being a NO - neither are long shots.

So are we in the money?!

Negative. Slightly worse off than we were last week.

Joby is trading around $4.86 per share and our breakeven is $5.22. So we are down a little over $8K at the moment.

But we’re not day trading here. Time is on our side.

We have years…. Or until Joby runs low on cash and has to raise money and dilutes shares, but we’ll cross that bridge when we get there.

Lighten Up

Final Question

What will be your pre-flight routine before getting on an eVTOL? — best reply gets a shoutout next week.

Best Answer From Last Week

I asked “Will you pay Uber Black Prices to take an eVTOL?”

Best reply came from Leslie in South Carolina:

“Anyone that switched from old school taxis to Uber because they’re more convenient will pay absolutely pay Uber black prices for eVTOLs. It’s a no brainer.

Thanks for reading and let us know what you want to see more of next week. We read every single reply.

Stay above.

— The Above Traffic Team

WIll be

Reply